While the digital economy growth has been a hot topic for quite some time now, COVID has had an impressive impact in accelerating the adoption of technology in most sectors.

Table of Contents

With home lockdowns becoming the norm across the globe, one of the most meaningfully impacted sectors has been retail consumption. People still had needs to be satisfied which has forced the e-commerce industry to develop in a matter of months what some had predicted would take years.

To put this in numbers, online retail sales are up +50% vs. pre-pandemic levels. Or stated differently, the total value of online retail sales at present is $4.9 trillion.

With growing demand from consumers for online purchases, supply didn't take long to catch up. You could have expected traditional retailers to transition fast enough to meet the booming online demand but in many cases they were too big to execute at the pace the market needed.

As such, what we have seen is the surge of digital sellers. These sellers are typically smaller organizations, more nimble and flexible, which has positioned them to become main beneficiaries of the structural changes in online shopping.

They were additionally aided by the development of easy logistics, e-commerce focused ERPs, the well-known buy-now-pay-laters, ultra-low interest rates, and the surge of niche marketplaces.

In fact, about 50% of the $4.9 trillion in online sales, takes place via marketplace platforms. While so far everything looks great, the reality is that many of them struggle to meet up with demand.

As more and more of these sellers claim their piece of the global e-commerce pie, an important question starts to gain importance: who will finance all of this? The short answer is Ritmo, a key partner for small business funding.

But before we go into that, let’s review the cost structure of these agents.

What is an FBA loan

FBA Loans, Amazon Seller loans or Amazon Vendor loans are working capital offered to ecommerce an marketplaces players on Amazon, Walmart… to expand their businesses.

As you may know, financing on Amazon is crucial to keep the engine moving. You need capital to buy more stock, buy more ads, hire more people… it's basically a pay to play for any online seller, so they need seller financing business.

Amazon seller loans are invitation-only restricted but, luckily for us, there are companies such as Ritmo which offer from €50,000 to €3 million in 24 hours to invest in inventory and in your online marketing campaigns.

What can I invest my FBA loan in?

Well, as we said, Sellers buy their stock, list it in marketplaces, and then sell it to the end customer. Quite simple, you would think.

Multiple costs for selling in marketplaces

Main costs are therefore:

- COGS

- shipping

- logistics expenses

- marketplace fees

- advertising

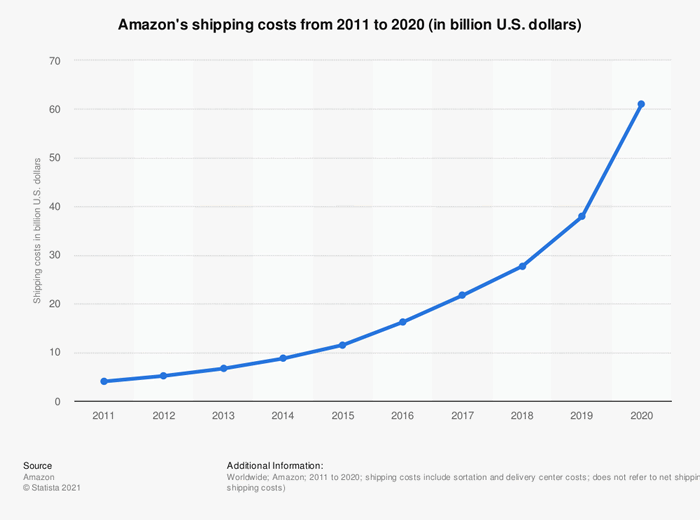

These costs amount for as much as 70% of total costs for these players, in some cases even more. Additionally, they need to invest in digital marketing to make sure they attract traffic to their products and these are well positioned among the vast selection available in marketplaces. Take a look at Amazon's shipping costs, for example (via Statista).

Upfront payments

One of the challenges sellers typically deal with is high costs before they are able to start selling as many suppliers require upfront payments before shipping the merchandise. Doing so also allows them to obtain discounts from suppliers that can go from 5% all the way up to 15%.

Marketing growth

Another challenge is increasing their marketing budgets. Thanks to technology, it is relatively easy to predict what the impact an additional dollar invested in digital marketing will have on sales. But that does not mean e-commerce businesses have unlimited resources to double or triple up their marketing efforts.

One thing the above-mentioned costs and expenses have in common is they are very closely related to sales. Unfortunately, the timing of the expenses rarely matches that of sales. With this becoming a growing pain for sellers, an innovative financing solution has emerged: revenue-based finance.

What is revenue based financing?

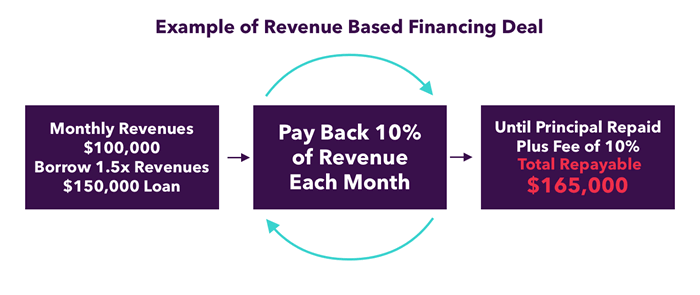

Revenue-based financing (aka royalty-based financing or revenue based lending) is a raising capital method that allows sellers to share a % of their business with investors or, let's put it this way, pay your loan sharing a % of your profits.

Let's take an easy example:

- I need $50,000 and I get it from a revenue based financing company

- I will return this loan on a monthly basis

- Do I have $5,000 on profits this month? Ok, so I can return $1,000 to the company

- Do I have $500 on profits this month? It's been a terrible month, so you don't have to return a pennie to the revenue based financing company

Eeasy peasy lemon squeezy.

And, believe, you better owe money to a revenue based financing company than to a bank or even Amazon Seller Financing.

Credits to Martin Macmillan

How can revenue based financing help me?

Revenue-based finance provides fast and flexible financing for sellers and e-commerce businesses in a seamless way.

Fast

Because it only takes about 24h to receive an offer.

Flexible

Because weekly repayments are linked to sales as a fixed % of these: if you sell more, you repay more, if you sell less, you repay less.

Seamless

Because all it takes is to connect your shopping platforms (Amazon Seller Central, Shopify, Stripe, Paypal, Prestashop, Aliexpress, WooCommerce…) and marketing accounts (Google Ads, Facebook Ads, Bing…).

The growing popularity of revenue based financing

Having easy access to capital is fun! Particularly for digital businesses who struggle to explain the peculiarities of their businesses to traditional financing providers like banks.

Not providing personal guarantees or collateral is also quite fun! Particularly as it allows you to sleep well at night if your container gets stuck in the Suez Canal or your Amazon account gets blocked for a couple of weeks.

But most importantly, RBF (revenue based financing) is booming because of two things:

Revenue based financing allows you to match the cost of the sale to the actual sale

You don't need to disburse a large amount of money upfront to your suppliers.

Instead, Ritmo pays their invoices and you only pay it back as you get the merchandise and sell it. You also don't need to make an unaffordable investment in digital marketing with your own funds. Instead, Ritmo takes care of the investment and you repay as this investment translates into higher sales.

If costs are closely related to sales, it makes sense to pay for them as you actually sell. Without entering into accounting technicalities, RBF improves operations by improving the inventory cycle, the sales cycle, and most importantly, the cash flow cycle!

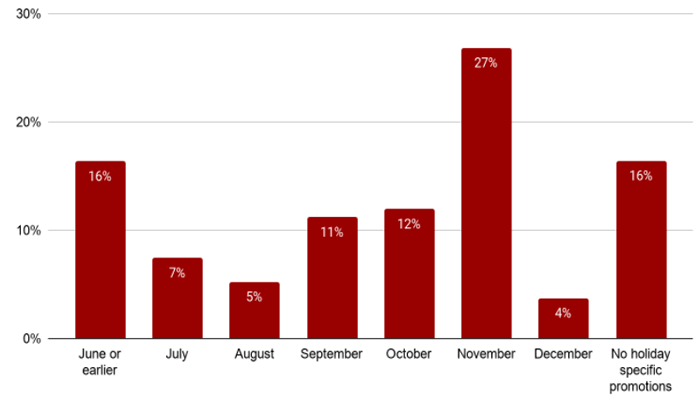

It adapts to business seasonality

Sellers and e-commerce businesses typically have more funds after their seasonality peak. However they need more funds before sales start to go up (not after) as they need to stock up more and make increasing marketing investments. Ritmo offers financing in a timely and strategic way so that sellers can have the necessary funds they need to prepare for the high season, and use the strong sales of those months to gradually pay back.

Traditionally, Q4 is the best quarter for most online sellers (and retailers in general), but preparation starts several weeks before. Over the next few weeks, sellers will start increasing their digital marketing budgets to make sure they wake up the appetite from consumers. Similarly, they will make larger orders to their suppliers anticipating the increased demand from their clients.

We believe sellers should be spending time thinking how to improve their offering to clients, but not on how they will pay for all the expenses they'll face in anticipation of higher demand. And we struggle to find a better way to solve this problem than an approved amount of funds to be used now but to be repaid when sales explode!

Credits to Channeladvisor

Alternatives to revenue based financing and FBA loans

RBF is obviously not the only choice an e-commerce business or seller has to access capital, but for certain recurring costs, like inventory and marketing, it is certainly the most appropriate and efficient one.

Let's consider a few alternatives.

Trade finance

Sellers get their invoices paid and postpone the payment by 30 to 60 days.

Undoubtedly useful, but it doesn't avoid a large cash outflow a few weeks down the road. Additionally, it does neither match the timing of the cost to the timing of the sale, nor it allows for an extension of the repayment period if sales come in weaker than anticipated.

Venture or private capital

We are big fans of VC money. They add tons of value and provide strategic capital to grow the team, develop products, invest in infrastructure, expand to other geographies etc. However, it is an arguably expensive source of capital (especially if you do well).

It is not efficient to finance recurring expenses with private capital.

Banking finance

Probably the only advantage is that it's cheap. Hidden cost, compounding interest rates, personal guarantees requirements, lengthy contracts, time-consuming processes… I'll leave it there.

Amazon Lending

With the promise (overpromise, if you ask me) of “Working capital loans designed with your business needs in mind“, Amazon Lending provides financing options to help small and medium-sized businesses grow on Amazon.

But, believe, you don't want to owe money to Amazon nor a bank.

Amazon funding alternatives

Check some of the services available for Amazon and ecommerce funding we've reviewed so far:

Bottomline

While far from perfect, RBF is arguably one of the best financing alternatives to either scale online sales, or prepare for high season.

We expect retail consumption to continue transitioning from physical to online stores. With that, the need for flexible capital will only increase and we look forward to walking hand-by-hand with our clients and continue developing our solution to make sure they can continue growing in a seamless way!

For that purpose, we have also developed our growth analytics tool, Ritmo Insights, which aims to assist entrepreneurs in making better informed decisiones, allocate capital more efficiently and improve their return on investment metrics.

More posts

About the author

Jordi Ordonez

I’m an independent eCommerce and Amazon consultant.

Clients

I've worked with brands like Estrella Damm, Intersport, Bella Aurora, Lladró, Textura Interiors, Nice Things Palomas, Castañer, Due-Home, and many others.

Lecturer & Teacher

I’ve spoken and taught at events such as Meet Magento, PrestaShop Day, SEMrush, Cambra de Comerç Barcelona, ClinicSEO, EcommBeers, EcommBrunch, Ecommercetour.com, EcommFest, EOI, ESIC-ICEMD, Foxize, Generalitat de Catalunya, Inesdi, Quondos, and The Valley. I’ve also delivered in-company training sessions for major brands like Orange and Adidas.

Writer

I regularly contribute articles to the Helium 10 blog, Shopify, SEMrush, La Vanguardia, eCommerce News, Marketing4ecommerce, and others.

Partner

Helium 10, Jungle Scout, Avask, Helium 10 Seller Solutions Hub Partner, SaaS4Marketing, H10-wp.com, FBASuite.com, and a Trusted Partner of Tracefuse.

Social

LinkedIn, Twitter, Wikipedia, YouTube, Quora, ISNI 0000000513224289, About Jordi Ordonez