Avalara is an Amazon tax compliance software designed to automate tax processes and improve accuracy while reducing costs for businesses. Sounds great, does it?

Table of Contents

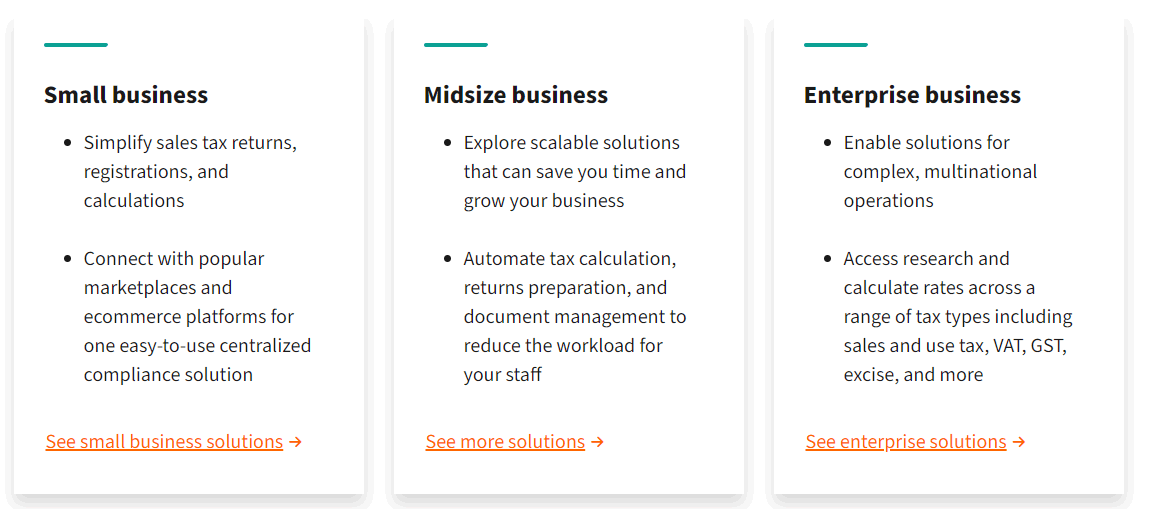

Avalara offers both tools and services for various tax types such as sales and use tax, consumer use tax, international compliance, and property tax. Avalara is for small businesses, midsize businesses and enterprises and helps them stay compliant and grow safer in an omnichannel, international tax environment.

Subscribe & get 18 discounts for Amazon tools (up to 80% off)

Ever sold in any Amazon Europan Marketplace? We have 23 different countries with 23 different VATs and different VAT tiers for products, plus other “magical” stuff as documents you need to file to sell on Amazon France or Germany (EPR, extended producer responsibility), EORI numbers to sell in the UK… it's a non-stop party. Well, if you have already read my Avask Accounting review you know what you're dealing with.

Features and services

Avalara has a hand full of services for tax compliance worldwide (+190 countries). Check them out:

Tax compliance software

- Automation of tax compliance processes

- Improved accuracy in tax calculations and returns

- Smooth international compliance

- Identifying taxability and applying accurate tax rates

- Handling cross-border sales and customs duties

- Integration with existing business applications through API

Services for Amazon (and online) Sellers

- Company and personal property tax management

- Access to tax research and content for informed compliance decisions

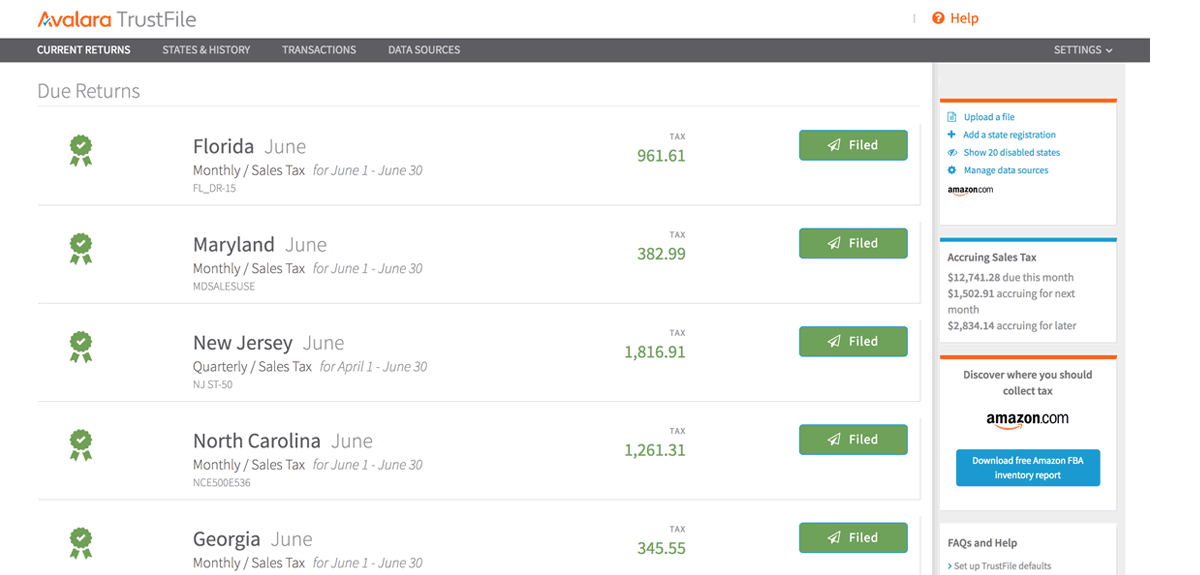

- Returns: manage sales tax returns for your company

- e-Invoicing: automate finance operations

- Amazon invoicing generation

- Cross-Border: they manage duties and tariffs for you

- Exemption Certificate Management

- Business Licenses

- Sales Tax Risk Assessment

- Tax obligations across the U.S.

Pricing

The pricing for Avalara is not specified, they offer customized pricing based on the specific needs and requirements of each business. So you best reach out to Avalara directly for pricing details.

Integrations

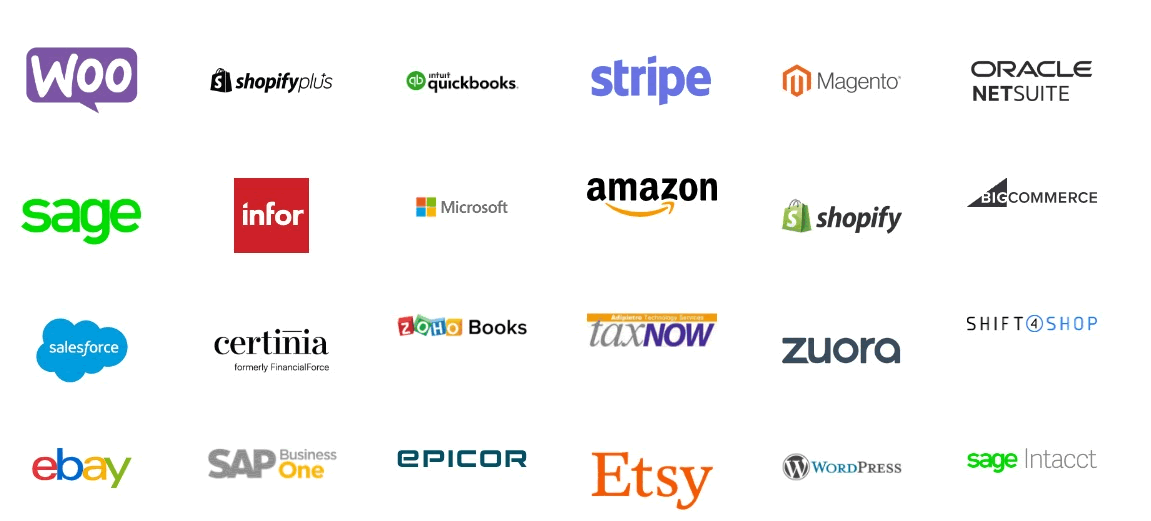

Avalara integrates with a wide range of business applications, including but not limited to:

- ERP systems

- eCommerce platforms

- Order management systems (OMS)

- Point of sale (POS) systems

- Subscription recurring billing software

- Supplier management and AP automation software

Some popular integrations are:

- Bigcommerce

- Epicor

- Salesforce

- Infor

- Taxnow

- Magento

- Microsoft Dynamics

- NetSuite

- QuickBooks Online

- Sage

- Shopify & Shopify Plus

- Stripe Invoicing

- Zuora

- And other platforms

Avalara reviews

If you came here to decide wether you need Avalara tax compliance software or Avalara's services, trust my words: you need them. Dealing with Amazon taxes can be a painful task and you don't want that on your table. So, why not leave it in the hands of an expert? Avalara's Amazon services are recommended by the company itself.

Avalara is a robust tax compliance software that can be a valuable asset for businesses of all sizes, especially for those selling on Amazon and other online platforms, and its customization and integration capabilities make it a flexible solution for various business needs.

However, the lack of transparent pricing should be considered before making a decision (meaning: they're expensive, but worth it).

Our score

- Number of features (5)

- Pricing (3)

- Learning curve (4)

- User friendly (4)

Alternatives to Avalara

Here you can find the top Avalaras alternatives